What is a Memecoin? – A Beginner’s Guide to Doge, Shiba & Beyond

What happens when internet memes meet crypto assets? You get memecoins. Originally launched in 2013 as a joke based on a Shiba Inu dog meme, Dogecoin started as satire but grew into a multi-billion-dollar digital currency used around the world. In 2025, memecoins like Dogecoin, Shiba Inu, and PEPE aren’t just internet jokes, they’re cultural and financial phenomena.

This blog breaks down the essentials: What is a memecoin? Why are they so popular? And are they a real investment opportunity or just another trend? By understanding these meme-powered tokens, you’ll gain insight into one of the most unique corners of the crypto universe.

But before diving into the world of Memecoins, it’s important to understand basics of crypto and for that read The Ultimate Guide to Crypto Assets.

What is a Memecoin?

A memecoin is a type of crypto asset that’s built around internet jokes, viral trends, or popular culture references, often launched without a serious technological use case. Unlike Bitcoin or Ethereum, which were designed with clear utility and innovation goals, memecoins are mostly driven by community support, social media hype, and online humor.

Dogecoin, the original memecoin, was created as a playful response to Bitcoin, using a Shiba Inu dog as its mascot. Since then, other memecoins like Shiba Inu and PEPE have followed, growing large communities and catching the attention of crypto traders.

While memecoins may lack technical depth, they’ve proven that strong memes and active online followers can influence crypto markets. Their appeal lies in their accessibility, low cost, and potential for massive short-term returns, even if they’re often seen as speculative bets rather than serious investments.

How Do Memecoins Work?

Memecoins operate like other cryptos, they are built on blockchain networks such as Ethereum, often following the ERC-20 token standard. However, unlike coins with technical or financial applications, memecoins generally lack a defined utility. Instead, they function primarily as speculative assets.

What really drives the value and attention around memecoins are emotional and cultural forces. Their price is rarely linked to development progress or adoption rates.

Key drivers of memecoins include:

- Viral memes and humorous branding

- Hype on platforms like Twitter, Reddit, and TikTok

- Celebrity endorsements and public figures

- Fear of missing out (FOMO) and community buzz

For example, Elon Musk’s tweets have repeatedly influenced Dogecoin’s price, sending it soaring or crashing within minutes. This volatility makes memecoins exciting, but also risky for traders.

The Rise of Memecoins

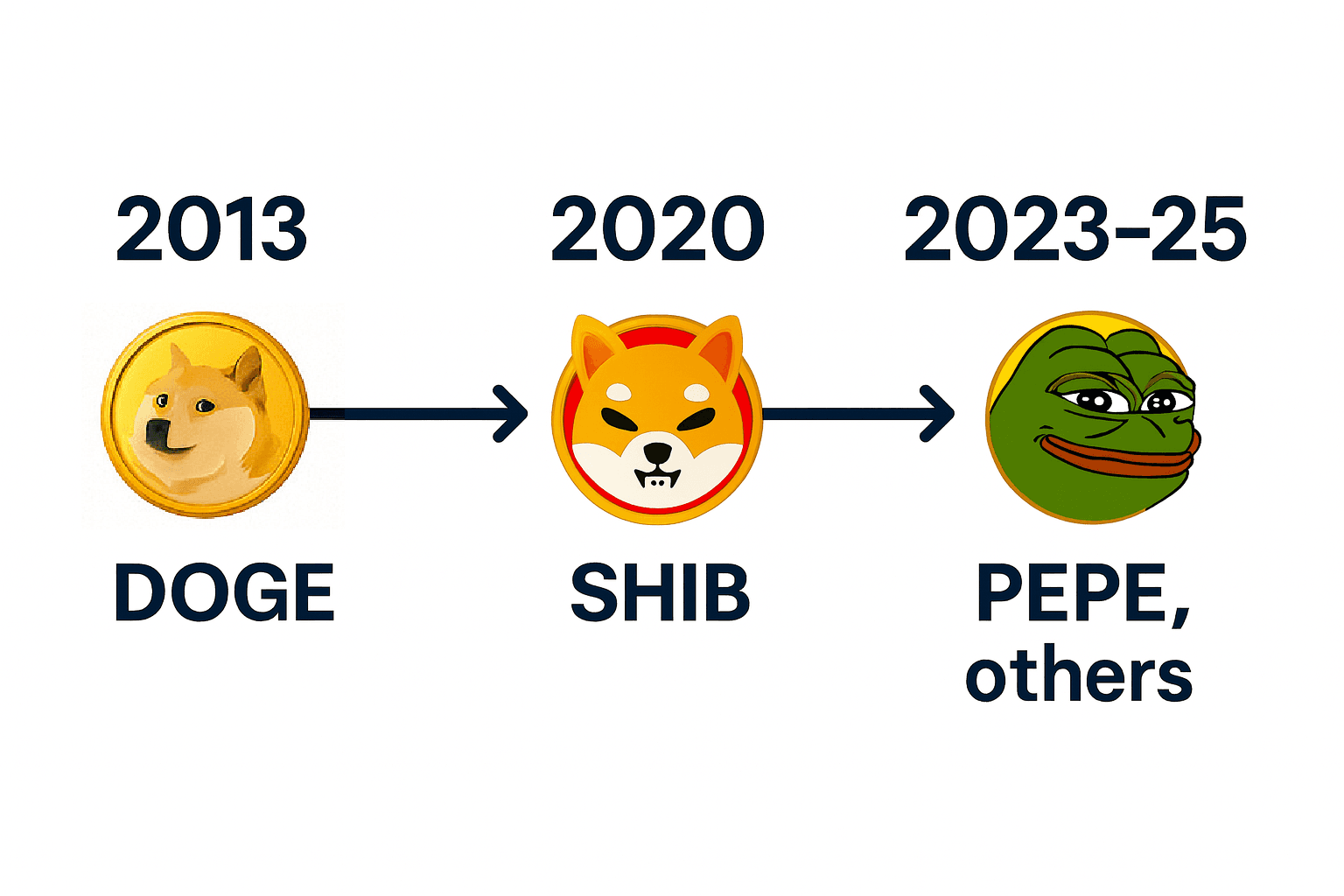

The journey of memecoins began with Dogecoin in 2013. Created as a joke, Dogecoin quickly gained traction thanks to its fun branding and active community. Over time, it climbed into the top 10 crypto assets by market cap, especially after endorsements from figures like Elon Musk.

In 2020, Shiba Inu entered the scene as an Ethereum-based token. Marketed as the “Dogecoin killer,” it built a strong DeFi presence and gained popularity through aggressive marketing and loyal community support.

Later, in 2023–2025, newer memecoins like PEPE gained attention by leveraging meme culture and viral content. Platforms like Reddit, Twitter (X), and TikTok played a major role in their rise, amplifying hype through humor, memes, and influencers.

While often dismissed as jokes, these coins have consistently shown they can move markets when the internet pays attention.

Why Are Memecoins So Popular?

- Accessibility: Memecoins are often priced very low, making them appealing to new investors. Buying thousands or even millions of tokens for a small amount gives a sense of ownership and excitement.

- Community and culture: These coins thrive on internet humor, memes, and shared experiences. This makes communities like Dogecoin or Shiba Inu extremely loyal, turning casual holders into passionate advocates.

- High-risk, high-reward speculation: Because they’re not tied to fundamental value, memecoins can rise or fall dramatically in short periods. Traders hoping for big gains are attracted to this volatility.

- “Lottery ticket” mentality: Many view memecoins as a small bet with the potential for huge rewards. The dream of “getting in early” on the next viral coin fuels ongoing interest and participation in this asset class.

Risks of Investing in Memecoins

- Extreme volatility: Memecoin prices can swing wildly within minutes based on tweets, rumors, or social media hype. This makes them risky even for experienced traders.

- Pump-and-dump schemes: Many memecoins are created purely to inflate in price quickly and crash just as fast. Early buyers profit while late investors suffer losses.

- Lack of real-world utility: Unlike Bitcoin or stablecoins, most memecoins have no underlying use case, making them harder to evaluate based on fundamentals.

- Rug-pulls and scams: New tokens often appear with flashy marketing and disappear just as quickly. Developers can pull liquidity, leaving holders with worthless tokens and no recourse.

Do Memecoins Have a Future?

While many memecoins fade quickly, a few have evolved into more serious projects. A prime example is Shiba Inu, which grew from a joke token into a broader ecosystem featuring Shibarium, a Layer 2 blockchain and utilities like decentralized exchanges and NFTs. This shows that memecoins can mature if they build real use cases.

Speculation will likely remain a major driver, especially during bullish market cycles. However, only a handful of memecoins may endure long-term, as most lack fundamentals. Memecoins are now part of the larger crypto pop culture, capturing attention from both seasoned traders and curious newcomers.

At the same time, regulators are becoming increasingly watchful of risky speculative tokens. Projects without clear utility or transparency may face restrictions or legal action in certain regions.

Final Thoughts - More Than Just a Joke?

Memecoins have evolved from internet jokes into a notable category of crypto assets. While many dismiss them as unserious or risky, their explosive popularity highlights how culture, community, and humor can drive financial activity. Tokens like Dogecoin, Shiba Inu, and PEPE have captured attention far beyond the typical crypto audience.

Yet memecoins are not just harmless fun. They come with extreme volatility, lack of utility, and frequent scams. Investors should approach them with caution, fully understanding the risks involved. However, their cultural significance in the crypto ecosystem shouldn’t be ignored.

In a space driven by innovation, memecoins reflect the creative and unpredictable nature of digital assets. For some, they’re speculative lottery tickets. For others, they’re a way to engage with the crypto world. Either way, memecoins are now firmly part of the industry’s story.

Keep in mind that, this blog does not give any financial advice.