What is a Stablecoin and Why Do They Matter?

Stablecoins have become a vital part of the crypto ecosystem, acting as a bridge between traditional finance and digital assets. These coins are designed to maintain a stable value, typically pegged to a fiat currency like the US dollar.

Their rise in popularity has been remarkable, with billions in daily trading volume across crypto markets. This growth reflects how essential stablecoins have become for traders, institutions, and decentralized finance (DeFi) platforms alike.

In this guide, readers will gain a clear and beginner-friendly understanding of what a stablecoin is, how it works, and why it plays such a critical role in the broader digital economy. Whether you're new to crypto or looking to deepen your knowledge, this article will provide the foundation needed to navigate stablecoins confidently.

What is a Stablecoin?

A stablecoin is a type of digital asset designed to keep its value steady, unlike other crypto assets that can experience sharp price swings. The core purpose of a stablecoin is simple:

- Price stability in crypto markets.

Stablecoins are usually pegged to stable assets like the US Dollar (USD), the euro (EUR), gold, or even a basket of commodities. This peg ensures that each stablecoin maintains a predictable value, typically 1:1 with the chosen asset.

As a result, stablecoins act as a reliable medium of exchange and store of value within the crypto ecosystem. They also serve as a critical bridge between crypto and fiat currencies, allowing traders and institutions to move funds easily without exposure to high volatility.

How Do Stablecoins Work?

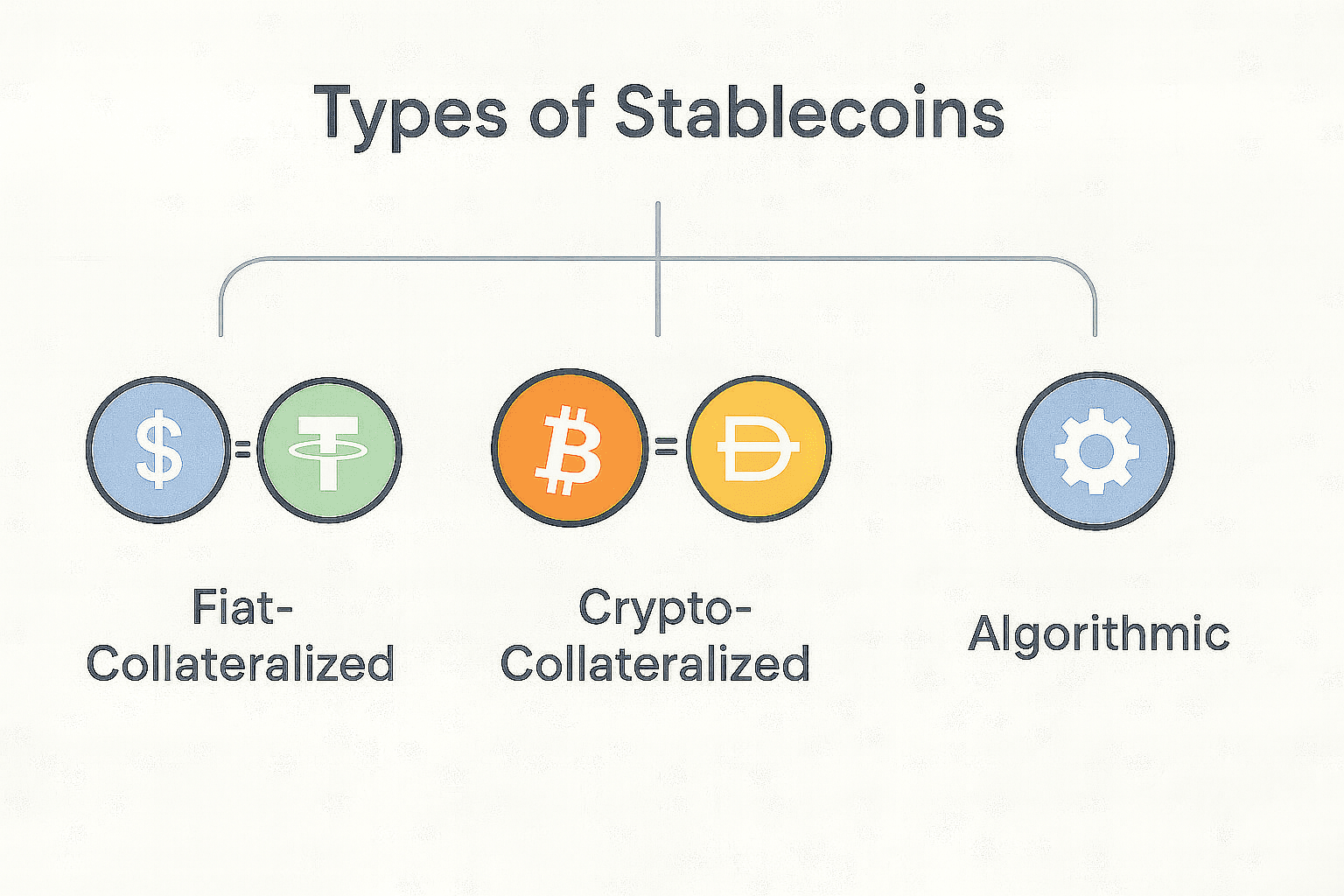

A stablecoin works by maintaining a stable value through different peg mechanisms and reserve systems. The basic idea is simple: each stablecoin is tied, or “pegged,” to the value of another asset to avoid the price swings common in the crypto world. There are several types of peg mechanisms:

- Collateralized with fiat: These stablecoins, like USDT and USDC, are backed by real-world currency reserves held in banks.

- Collateralized with crypto: Examples like DAI use other crypto assets as collateral, creating stability through over-collateralization.

- Algorithmic stablecoins: These rely on code to manage supply and demand, though historical examples like UST show the risks involved.

Each method aims to provide stability, but their reliability varies depending on design and market conditions.

Types of Stablecoins

There are several types of stablecoins, each with its unique design and purpose in the crypto ecosystem:

- Fiat-backed stablecoins: These are pegged to traditional currencies like the USD and are fully backed by reserves held in banks.

- Crypto-backed stablecoins: These use crypto assets as collateral and are often more decentralized in design.

- Algorithmic stablecoins: These rely on code and smart contracts to maintain their peg without physical reserves.

- Exchange-based stablecoins: Issued by crypto exchanges, these are backed by fiat and act as alternatives to traditional currencies within trading platforms.

Each stablecoin type plays a vital role in ensuring market stability.

Why Do Stablecoins Matter?

Stablecoins have become a critical part of the crypto ecosystem thanks to their versatility and stability. Here’s why they matter:

- Liquidity in crypto trading: Stablecoins serve as a base pair on exchanges, making trading smoother.

- Protection against volatility: They provide a safe haven during market swings without leaving the crypto market.

- Enabling DeFi: Stablecoins are essential for borrowing, lending, and yield farming activities across DeFi platforms.

- Cross-border payments and remittances: They enable fast, low-cost international transactions.

- On/off ramp between fiat and crypto: Stablecoins make it easy to move value between traditional finance and crypto markets.

This balance of stability and utility is what makes stablecoins so important today.

Popular Stablecoins in 2025

- Tether (USDT) – The largest stablecoin by market cap, USDT remains the most traded pair on major exchanges, providing liquidity across the crypto ecosystem.

- USDC (USD Coin) – Known for its strong regulatory backing and transparency, USDC is widely used by institutions and DeFi platforms.

- DAI – A crypto-backed stablecoin governed by smart contracts, DAI is favored for its decentralized nature and role in supporting decentralized finance applications.

Each of these stablecoins plays a vital role in keeping the crypto markets efficient and stable.

Cryptal’s Stablecoins – TOGEL, TOUSD and TOEUR

As we have learned, there are several types of stablecoins. One type of coin is created solely for use on crypto exchanges, and we also find them on the Georgian platform Cryptal.

Due to regulations, traditional fiat currencies like GEL, USD, or EUR are not directly available, but users can still deposit them into their balance.

Once deposited, they are automatically converted into the corresponding stablecoin at an exact 1:1 value - 1₾ = 1 TOGEL; $1 = 1 TOUSD; 1€ = 1 TOEUR.

Risks and Challenges of Stablecoins

While stablecoins offer critical benefits, they also come with several challenges that users and investors must consider. Regulatory uncertainty remains a major issue. Different countries are introducing crypto regulations that may impact how stablecoins operate globally. Another key challenge is reserve transparency. Without regular audits, it can be hard to verify whether stablecoin issuers truly hold sufficient reserves to back their tokens.

Potential depegging risks also exist. If reserves are mismanaged or markets panic, a stablecoin might lose its peg. Algorithmic stablecoins have faced notable failures, with Terra’s UST collapse in 2022 serving as a stark reminder. This event highlighted how even innovative solutions can fail without proper safeguards. As the crypto sector matures, these risks demand close attention.

The Future of Stablecoins

The future of stablecoins looks dynamic as regulation trends continue to shape the space. Governments worldwide are drafting clearer rules, aiming to balance innovation and consumer protection in the crypto industry. Central Bank Digital Currencies (CBDCs) could compete with or complement stablecoins, depending on the region.

Institutional adoption is also growing, with large companies exploring stablecoin use for settlements and payroll. Innovations like yield-bearing stablecoins and multi-asset backing are emerging, offering new opportunities. As stablecoins evolve, they will likely remain a vital link between crypto and traditional finance.

Final Thoughts – Why You Should Care About Stablecoins

Stablecoins have become an essential part of modern crypto markets, offering stability in an otherwise volatile environment. They provide traders, investors, and institutions with a reliable tool for managing risk, accessing liquidity, and bridging the gap between crypto and fiat currencies.

Beyond trading, stablecoins play a crucial role in powering DeFi applications, enabling faster cross-border payments, and supporting financial inclusion.

As the crypto ecosystem matures, understanding stablecoins is key for anyone looking to participate in digital finance responsibly. Their impact will continue to grow as technology and regulation advance side by side.