Why 21 million Bitcoin (BTC)? – Everything you should know

Unlike fiat currencies, Bitcoin has a hard limit—only 21 million BTC will ever exist. But why?

This predefined cap makes Bitcoin truly unique in the crypto world. While central banks can print unlimited money, Bitcoin’s supply is permanently fixed, earning it the title of “digital gold.” Its scarcity is one of the reasons why more investors and institutions are treating it as a hedge against inflation.

In this guide, we’ll explore why Bitcoin was designed with a 21 million limit, how the code enforces it, and what the long-term impact will be once all coins are mined. Whether you're new to crypto or a seasoned trader, understanding this supply cap is essential for grasping Bitcoin’s value, its role in the broader ecosystem, and its financial future.

Why Was Bitcoin Limited to 21 Million?

The 21 million cap means that Bitcoin will never exceed a total supply of 21 million coins. This rule is hardcoded into its protocol and cannot be changed without a major consensus from the entire network, which is highly unlikely. Unlike fiat currencies that can be printed endlessly, Bitcoin’s supply is limited and predictable.

This cap is enforced through a process called mining, where new BTC is released as rewards to miners for validating transactions. However, the reward decreases over time through an event called “halving.” As of 2025, over 19.7 million BTC have already been mined, leaving fewer than 1.3 million left to be created in the future.

This built-in scarcity is one of the reasons why Bitcoin is often compared to precious metals like gold. It gives BTC a deflationary nature, increasing its appeal among long-term investors seeking value preservation.

How Is the 21 Million Limit Enforced?

The 21 million limit is hardcoded into the Bitcoin protocol and enforced through its consensus rules. No central bank, developer, or government can change this rule without agreement from the entire network. The primary mechanism that controls the release of new coins is the halving schedule.

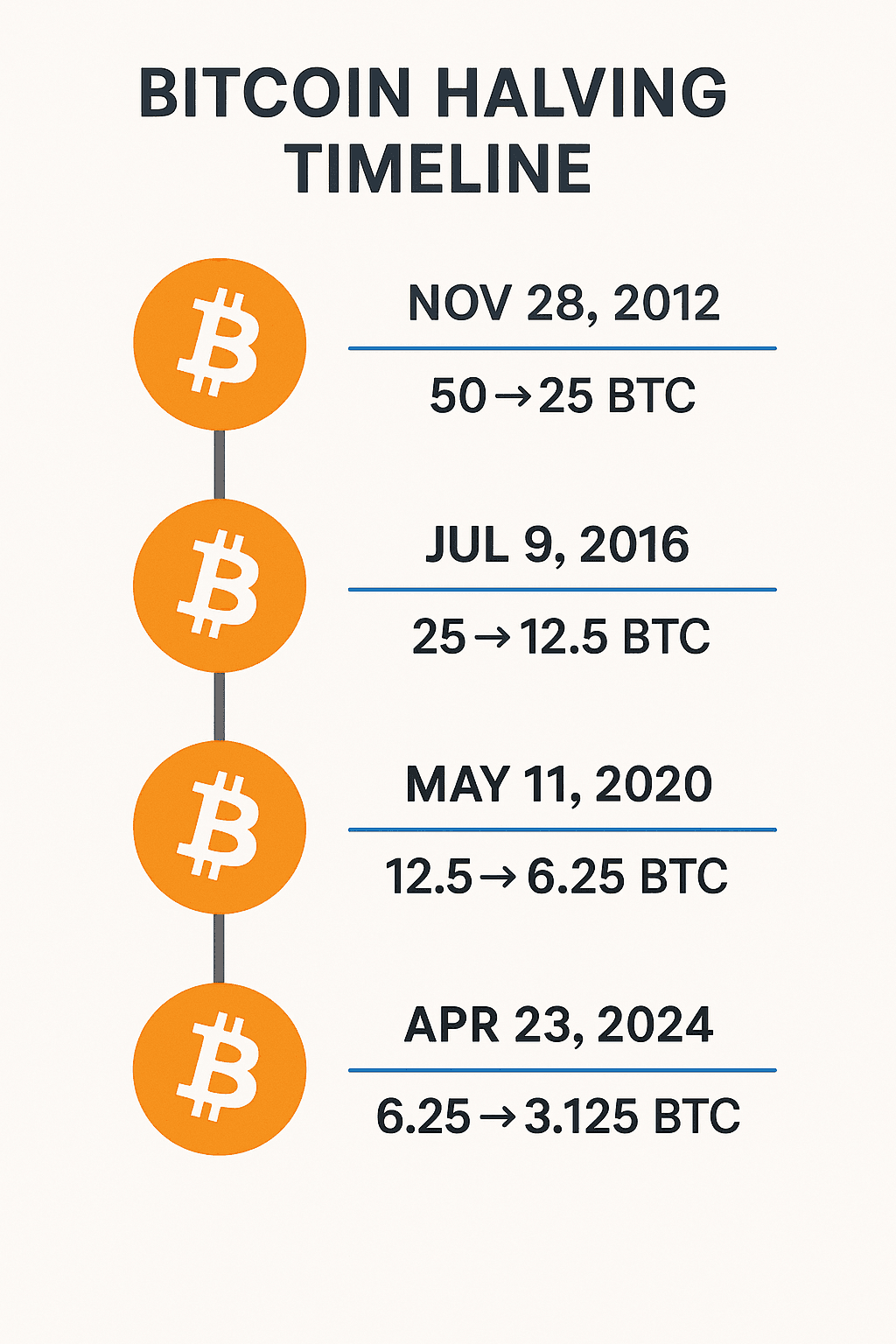

Bitcoin halving timeline:

- 2009: 50 BTC per block

- 2012: 25 BTC

- 2016: 12.5 BTC

- 2020: 6.25 BTC

- 2024: 3.125 BTC

- ~2140: Block rewards reach 0

Each halving occurs approximately every four years, reducing the number of new Bitcoins entering circulation. This gradual reduction ensures controlled supply and helps protect the network’s deflationary model. Over time, as rewards shrink, transaction fees are expected to sustain miner incentives, all while respecting the 21 million cap.

Why is Scarcity Important in Bitcoin?

Scarcity plays a crucial role in giving Bitcoin its value. In basic economic terms, when something is limited in supply but high in demand, its value tends to rise. This is the same principle that gives gold its worth, there’s only so much of it on Earth, and people want it.

Unlike fiat currencies, which governments can print endlessly, Bitcoin has a maximum cap of 21 million coins according to its Whitepaper. This hard limit creates digital scarcity, setting it apart as a deflationary asset. As more people recognize its potential, demand increases, while supply stays fixed.

This scarcity is a key reason why institutions and long-term investors view Bitcoin as “digital gold.” They see it as a hedge against inflation and an asset with long-term value.

What Happens When All 21 Million Bitcoins Are Mined?

By the year 2140, the final Bitcoin is expected to be mined, marking the end of new coin issuance. After that point, miners will no longer receive block rewards. Instead, they will earn income solely through transaction fees paid by users who want their transfers processed quickly.

This change raises important questions about network security. If transaction fees remain high enough, miners will still have an incentive to maintain the network. Otherwise, Bitcoin’s decentralized infrastructure could face risks.

Economically, a fully mined Bitcoin supply introduces the idea of extreme scarcity. With no new BTC entering circulation, some believe it could become ultra-deflationary, increasing in value over time. For users and investors, this means Bitcoin might serve as a more stable store of value, similar to rare commodities like gold.

Frequently Asked Questions About the 21 Million Limit

- Could Bitcoin ever change the limit?

It is extremely unlikely that the 21 million cap would ever change. Doing so would require consensus among thousands of decentralized nodes, an outcome so improbable it’s often considered impossible.

- What if BTC is lost forever, will that make the remaining coins more valuable?

Yes. Lost coins, from forgotten private keys or inaccessible wallets, reduce the active supply. As long as demand remains steady or increases, the scarcity can push the value of accessible BTC higher.

- Is 21 million enough for global use?

Absolutely. Bitcoin is divisible down to 0.00000001 BTC, known as one satoshi. That means even with 21 million coins, there are 2.1 quadrillion possible units available for transactions.

- Why was 21 million chosen?

The number was set by Bitcoin’s creator, Satoshi Nakamoto, to establish a clear, finite supply from day one, mirroring gold’s scarcity and resisting inflation trends common in fiat currencies.

- What does reaching the cap mean for miners?

Once new BTC issuance stops around 2140, miners will rely entirely on transaction fees. If fee revenue remains sufficient, the network's security and decentralization can still hold strong.

Summary – Why the 21M Cap Matters

The 21 million cap is not just a technical limit, it’s a defining feature of Bitcoin's design. Unlike fiat currencies, which can be printed in unlimited quantities, Bitcoin's supply is strictly finite. This built-in scarcity is what gives BTC its appeal as a hedge against inflation and positions it as digital gold in today’s financial ecosystem.

By limiting supply, Bitcoin establishes a system where demand can naturally influence value without manipulation from central authorities. It also encourages long-term holding and responsible monetary behavior. Understanding this cap is essential for anyone serious about Bitcoin. As the world looks for alternatives to inflation-prone currencies, Bitcoin’s fixed supply remains one of its strongest value propositions.

Want to dive deeper? Explore our full guide on What is Bitcoin? to understand the foundation of this revolutionary asset.