Hot Wallet vs Cold Wallet: What’s the Difference?

Not all crypto wallets are built the same. Some are connected to the internet, others stay entirely offline. As the value of digital assets continues to grow, secure storage is more important than ever. Whether you’re a casual holder or an active trader, protecting your funds from hacks and unauthorized access is critical.

That’s where the hot wallet vs cold wallet debate comes in. These two storage methods differ greatly in terms of security, convenience, and usage. Understanding how they work and when to use each one is essential knowledge for anyone managing crypto assets.

If you're just getting started with wallet basics, make sure to read our Beginner’s Guide to Crypto Wallets before exploring further.

What is a Crypto Wallet? – Quick Recap

A crypto wallet is a digital tool that allows users to store, send, and receive crypto using a pair of cryptographic keys, public and private. The public key is like an address you can share, while the private key grants full access to your assets. Wallets come in two main forms: software-based or hardware-based, and they can be either custodial or non-custodial.

- Software Wallets: Apps or programs on your phone or computer. Easy to use, but online risks exist.

- Hardware Wallets: Physical devices that store keys offline. Highly secure but less convenient.

- Custodial Wallets: Managed by exchanges or platforms; you don’t control the keys.

- Non-Custodial Wallets: You hold full control of your private keys. Greater responsibility, but more security.

What is a Hot Wallet?

A hot wallet is a type of crypto wallet that stays connected to the internet. Because it’s always online, it allows for quick and easy access to your digital assets at any time. Hot wallets are ideal for users who trade regularly or make frequent transactions.

Common types of hot wallets include:

- Mobile Apps like Trust Wallet or MetaMask

- Web Wallets provided by exchanges such as Binance or Coinbase

- Desktop Wallets installed directly on a PC or laptop

Hot wallets are widely used for trading, quick transfers, and on-the-go transactions. However, their internet connection also makes them more exposed to potential cyber threats.

Pros:

- Convenience

- Speed

- Easy to set up

Cons:

- More vulnerable to a hack

- Relies on an internet connection

- Requires active security practices

What is a Cold Wallet?

A cold wallet is a type of crypto wallet that remains completely offline. It stores digital assets without any active internet connection, making it a highly secure option for protecting funds from online threats. Cold wallets are ideal for users who prioritize security and plan to hold assets for the long term.

Common types of cold wallets include:

- Hardware Wallets like Ledger and Trezor

- Paper Wallets that store private keys on physical paper

- Air-Gapped Devices with no internet or wireless capability

These wallets are typically used for storing large holdings, especially by investors or institutions seeking to minimize risk. They are excellent for long-term storage but may be less convenient for daily transactions.

Pros:

- Maximum security

- Immune to most online threats

Cons:

- Less convenient for quick access

- Cost of hardware

- More complex for beginners

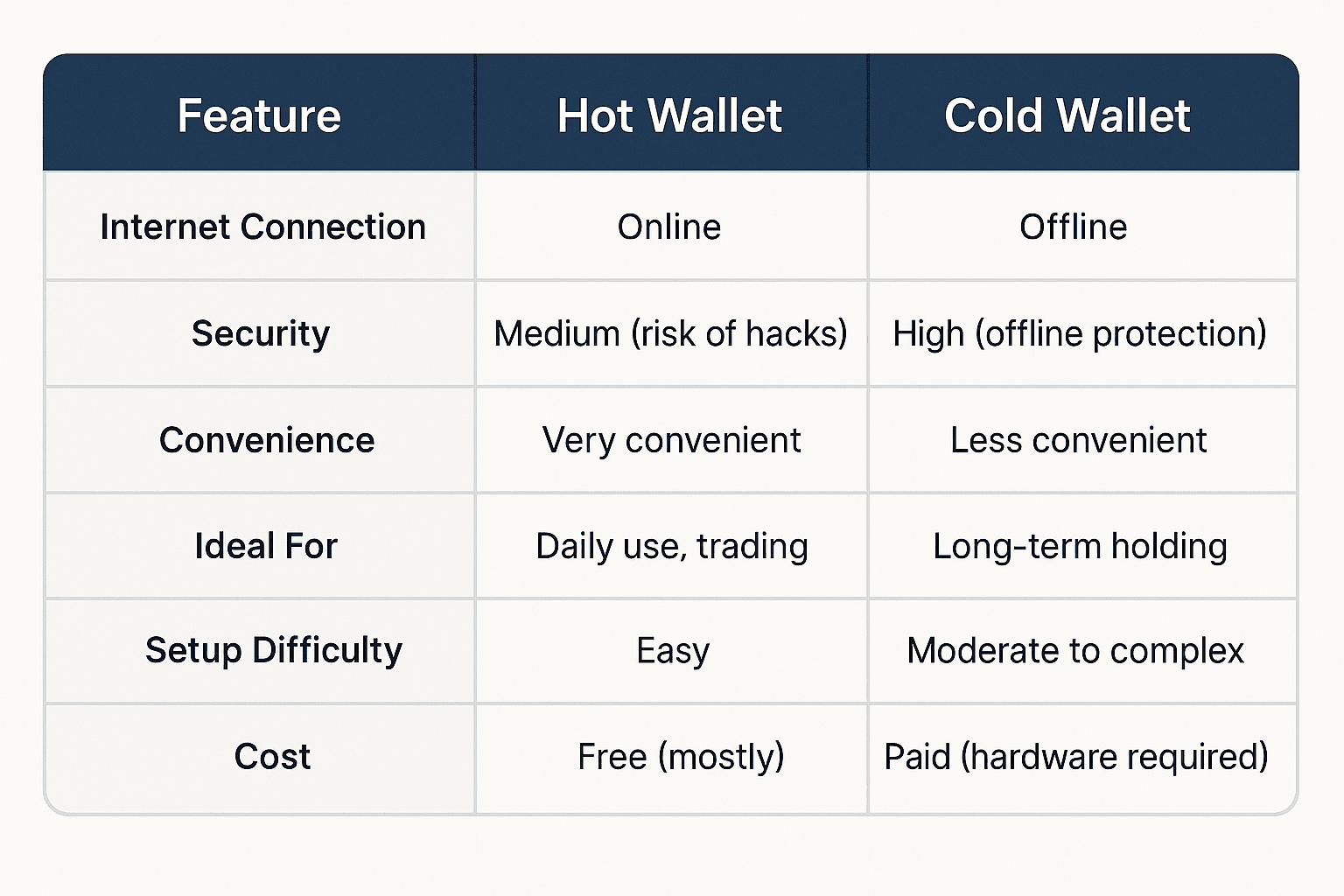

Hot Wallet vs Cold Wallet – Key Differences

Which Wallet Should You Use?

Hot wallets: are ideal for beginners, active traders, and those who need quick access to their funds. If you're frequently sending or receiving crypto, or participating in decentralized applications, a hot wallet offers the convenience and speed needed for daily use.

Cold wallets: on the other hand, are better suited for users who plan to store large amounts of crypto securely over the long term. For those who prefer to “HODL” or reduce exposure to online risks, cold storage adds a strong layer of protection.

Many users adopt a hybrid strategy, using a hot wallet for trading and everyday use, and a cold wallet for savings and high-value assets. This approach balances security with convenience, ensuring you're ready for both the short and long term.

Tips for Staying Safe with Both Wallet Types

Whether you use a hot wallet or a cold wallet, safety should always be your top priority. Follow these essential tips to protect your crypto assets effectively:

- Enable Two-Factor Authentication (2FA) on all wallet-related accounts for an extra layer of security.

- Backup your seed phrases securely and store them offline, preferably in multiple physical locations.

- Never share your private keys with anyone, regardless of the situation.

- Keep the hardware wallet firmware updated to patch any potential security vulnerabilities.

- Use trusted platforms like Cryptal for wallet access, exchanges, and portfolio management.

Combining these security habits with the right type of wallet ensures your digital assets remain safe, whether you're storing them or trading actively.

Crypto Wallet Glossary

- Crypto Wallet – A tool that stores private and public keys and allows users to send, receive, and manage crypto.

- Hot Wallet – A crypto wallet connected to the internet; typically, more convenient but less secure.

- Cold Wallet – A crypto wallet that stays offline, offering higher security for long-term storage.

- Private Key – A secret alphanumeric code that gives access to your crypto funds; never share it with anyone.

- Public Key – A code that acts like an address, allowing others to send you crypto.

- Seed Phrase – A series of 12–24 words generated when setting up a wallet, used to recover access if needed.

- 2FA (Two-Factor Authentication) – A security process that requires two forms of verification to access a wallet or exchange.

- Custodial Wallet – A wallet where a third party (usually an exchange) controls your private keys.

- Non-Custodial Wallet – A wallet where only the user controls their private keys.

Final Thoughts – Choosing the Right Wallet Strategy

There’s no universal wallet that fits every crypto user. Choosing between a hot wallet and a cold wallet depends on your goals, trading habits, and comfort with risk. If you're active in the market, a hot wallet offers the speed and access you need. On the other hand, cold wallets are ideal for long-term storage and peace of mind when holding larger amounts.

Smart investors often adopt a hybrid strategy, using a hot wallet for daily transactions and a cold wallet to safeguard long-term holdings. This approach balances accessibility and security, giving you the best of both worlds.

Before choosing a wallet, assess your usage patterns and risk tolerance.