Bitcoin’s Price History: From $0.01 to $100K

From a little-known digital experiment to a trillion-dollar asset, Bitcoin’s journey is nothing short of legendary. First traded for less than a cent, it has since captured global attention and reached valuations that were once unimaginable.

We’ll walk through major milestones, including early adoption, bull runs, crashes, and its rise as a mainstream financial asset. You'll also see how external events like regulation, institutional adoption, and market sentiment shaped Bitcoin’s price.

New to Bitcoin? Start by reading our What is Bitcoin? guide to understand the basics before diving into its price history

Bitcoin’s Humble Beginnings (2009-2010)

Bitcoin officially launched in January 2009 when Satoshi Nakamoto mined the first block, known as the Genesis Block. At that time, Bitcoin had no market price. It was purely experimental, shared among cryptography enthusiasts and open-source developers.

In 2010, the first recorded Bitcoin transaction occurred when someone paid 10,000 BTC for two pizzas, now known as the legendary “Bitcoin Pizza Day.” That year, Bitcoin’s first price was set on an exchange at around $0.01. The idea of digital scarcity was just beginning to gain traction, and only a small community believed in its future potential.

This early period laid the foundation for everything to come, marking Bitcoin’s quiet entry into a world it would one day disrupt.

First Bull Run and First Crush (2011)

In 2011, Bitcoin crossed the $1 mark for the first time, sparking interest among early adopters and tech-savvy investors. The price quickly rose to around $31 by June, fueled by growing media attention and increased trading activity on early platforms like Mt. Gox.

However, the excitement was short-lived. A major hack at Mt. Gox and lack of regulatory clarity caused panic selling. By the end of the year, Bitcoin’s price had crashed back down to around $2.

This event was the first major reminder of how volatile the crypto market could be. Still, it helped harden the community and proved that Bitcoin could survive even dramatic drops.

The $1,000 Milestone (2013)

2013 was a breakout year for Bitcoin. Starting the year around $13, it steadily climbed in value as global interest in crypto began to rise. By November, Bitcoin reached the $1,000 mark for the first time driven by media headlines, a rise in Chinese trading, and growing belief in its potential as a digital currency.

But this surge didn’t last. Regulatory warnings, exchange shutdowns, and the collapse of Mt. Gox in early 2014 triggered another major crash.

Despite the drop, the $1,000 milestone marked Bitcoin’s arrival on the global financial stage. It showed that this digital asset was no longer a fringe experiment, it had economic weight.

The 2017 Bull Run – Bitcoin Goes Mainstream

In 2017, Bitcoin went from a niche investment to a global talking point. Starting the year at around $1,000, BTC surged to nearly $20,000 by December. This bull run was fueled by media hype, retail investor enthusiasm, and the launch of Bitcoin futures on major exchanges.

The spike also triggered global regulatory discussions, with many countries beginning to take crypto more seriously. However, by early 2018, the market corrected sharply, with Bitcoin falling below $7,000.

Still, 2017 marked a cultural shift. Bitcoin was no longer just for tech insiders, it became a household name, prompting a wave of new users, exchanges, and regulatory frameworks.

Institutional Era & All-Time Highs (2020-2021)

Bitcoin entered a new era in 2020, as institutional investors began to take serious positions. Companies like MicroStrategy, Tesla, and Square added BTC to their balance sheets, citing it as a hedge against inflation. This institutional interest helped drive the price from under $10,000 in early 2020 to over $60,000 by April 2021.

Major payment platforms like PayPal and Visa began supporting crypto transactions, signaling mainstream acceptance. The rise of decentralized finance (DeFi) and growing concerns about fiat inflation further accelerated adoption.

While Bitcoin hit an all-time high of nearly $69,000 in November 2021, the market remained volatile, with dramatic corrections that followed.

Volatility, Regulation & Road to $100K (2022-2025)

From 2022 to 2025, Bitcoin faced a dynamic mix of challenges and breakthroughs. Regulatory discussions intensified globally, with governments seeking to define rules around crypto. Despite some restrictions, countries like the U.S., UAE, and Brazil began shaping clearer crypto frameworks, which helped build long-term investor confidence.

Volatility remained a key feature of the market. Bitcoin saw sharp drops, like during global rate hikes in 2022, but also impressive recoveries. By 2024, the halving event renewed bullish sentiment.

As adoption grew across developing nations and institutional demand surged again, Bitcoin pushed past the $100K mark in early 2025, cementing its position as digital gold.

Key Factors That Influence Bitcoin’s Price

Bitcoin’s price is driven by a combination of internal and external forces. First, supply and demand play a crucial role. With only 21 million BTC ever to exist, scarcity adds to its long-term value.

Another key driver is market sentiment. News, social media trends, and macroeconomic events can trigger rapid price swings. For instance, announcements by large institutions or regulations in major economies often influence investor behavior.

Halving events, which reduce the reward for mining Bitcoin roughly every four years, are also important. Historically, these events have been followed by bull markets.

Finally, global regulatory clarity, technological development, and institutional adoption remain major factors in shaping Bitcoin’s price trajectory.

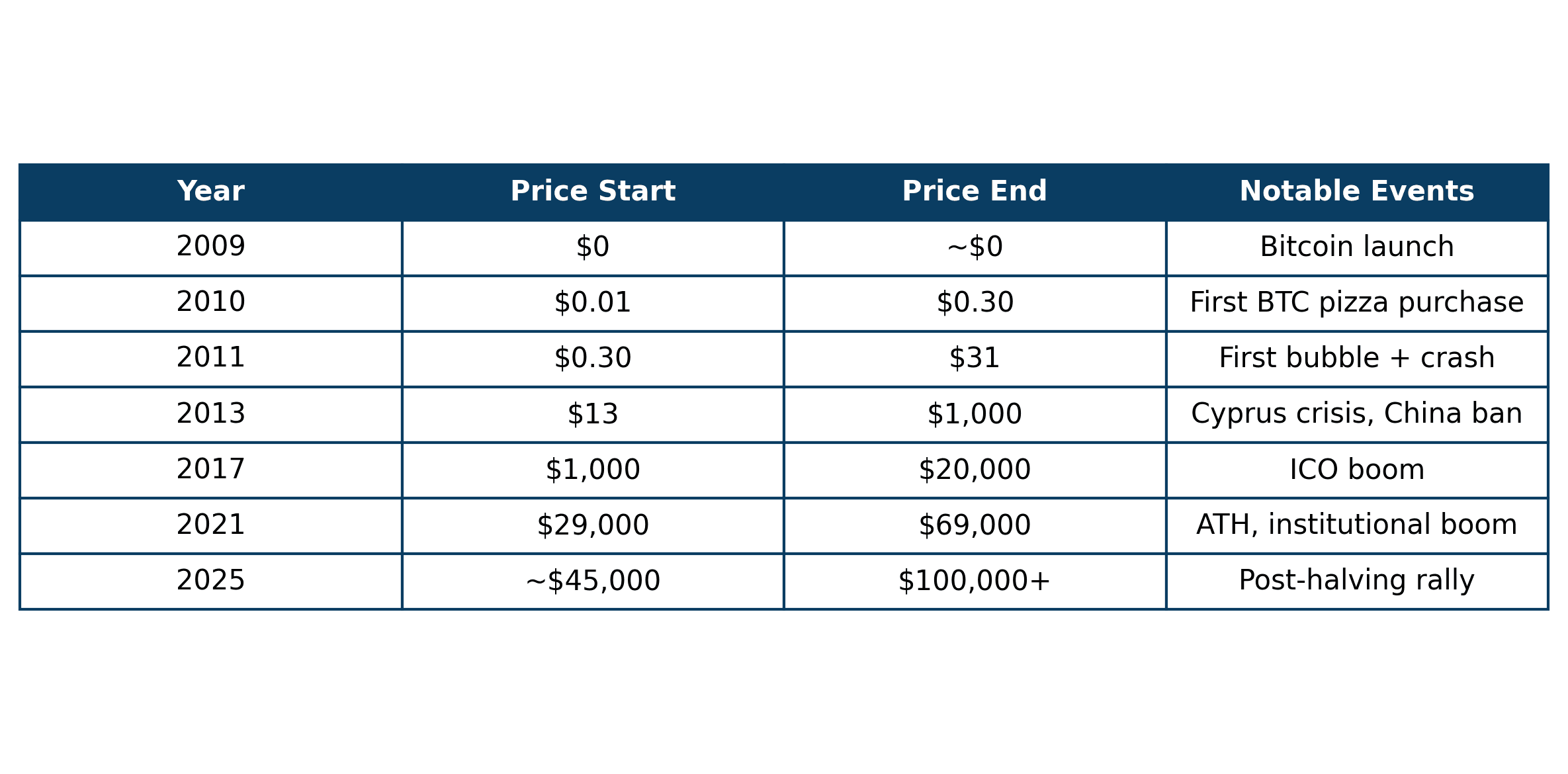

Bitcoin Price Timeline (2009-2025)

Bitcoin Live Price

Summary – Lessons from Bitcoin’s Price Journey

Bitcoin’s journey from a few cents to $100,000 has redefined how we view money, technology, and investing. Along the way, it faced extreme volatility, criticism, adoption by institutions, and increasing regulation. Each price milestone told a story - from internet experiment to a global asset.

One of the biggest lessons is that Bitcoin’s price isn’t just about numbers, it’s about belief, scarcity, and decentralization. While no one can predict future prices, the history shows its resilience and growing role in the global economy.

For anyone interested in Bitcoin, understanding its price history is essential. It reveals how technology, sentiment, and global events shape the value of this digital asset.