Bitcoin vs Savings – Which One’s Better?

In today’s financial landscape, many Georgians face a common dilemma: should one allocate funds into a traditional savings account with a bank, or invest in Bitcoin (BTC) as a growing crypto asset?

Savings accounts offer predictability and government backing, while Bitcoin provides high return potential but comes with volatility and risk. This comparison matters more than ever given local interest rates and rising public awareness about digital assets.

By exploring how Bitcoin performs against savings, beginners and enthusiasts alike can make more informed decisions tailored to their risk appetite and financial goals.

To understand better what this crypto asset offers, users can read our blog about What is Bitcoin? and access full description of the most famous digital currency.

What Does “Saving” Mean in Traditional Terms?

How Bank Savings Work

Traditional savings accounts remain one of the most common ways for Georgians to secure their money. When depositing funds into a bank account, users allow the institution to use their capital for lending or investments, while earning a fixed interest rate in return.

Banks like TBC and BOG offer annual interest rates that depend on currency type and duration, generally providing safety under government regulation.

Pros and Cons of Traditional Savings Accounts

The advantages of savings accounts lie in their stability and accessibility, offering predictable returns and liquidity. However, the main downside is low interest rates, often failing to keep pace with inflation, limiting long-term wealth growth compared to assets like Bitcoin.

What Makes Bitcoin Different from Savings?

Bitcoin as a Store of Value

Unlike bank deposits, Bitcoin (BTC) operates independently of governments or institutions. Its value is driven by global demand and capped supply, only 21 million BTC will ever exist. This limited quantity makes Bitcoin a digital store of value, often compared to gold.

Volatility and Risk Factors

Bitcoin’s strength lies in its growth potential, but its price fluctuates significantly. For beginners, this volatility can mean short-term losses, though historically it has offered higher long-term returns than traditional savings. Bitcoin Price History has shown many successful examples.

Accessibility and Ownership

With Bitcoin, users have direct control over their funds through secure wallets instead of relying on banks. Ownership is fully personal, transparent, and borderless, making it a strong alternative for those seeking independence.

Bitcoin vs. Savings: Detailed Comparison

- Profit Potential – Bitcoin (BTC) has historically delivered far higher long-term returns compared to traditional savings accounts. While savings earn fixed interest rates, Bitcoin’s value can multiply over time depending on market cycles.

- Liquidity – Both are easily accessible, but Bitcoin can be converted instantly into GEL through platforms like Cryptal’s Convert feature.

- Security – Bank deposits are insured, but Bitcoin’s security depends on user knowledge and storage. A reliable Bitcoin Wallet ensures maximum protection.

- Inflation Resistance – Bitcoin’s fixed supply of 21 million BTC prevents inflation, unlike fiat savings affected by changing economic conditions.

- Accessibility – Anyone with an internet connection can hold or buy Bitcoin, while bank savings often require documentation and identity verification.

Real-World Examples: Bitcoin Growth vs. Savings Rate in Georgia

According to data, the average deposit interest rate in Georgia in early 2025 was about 10.97 % for lari deposits.

For Bitcoin, historical pricing data shows that in January 2025, Bitcoin’s average closing price was around USD 99,992.85 (for BTC).

By October 2025, Bitcoin prices were in the ballpark of USD 114,048.7 (October 1 close).

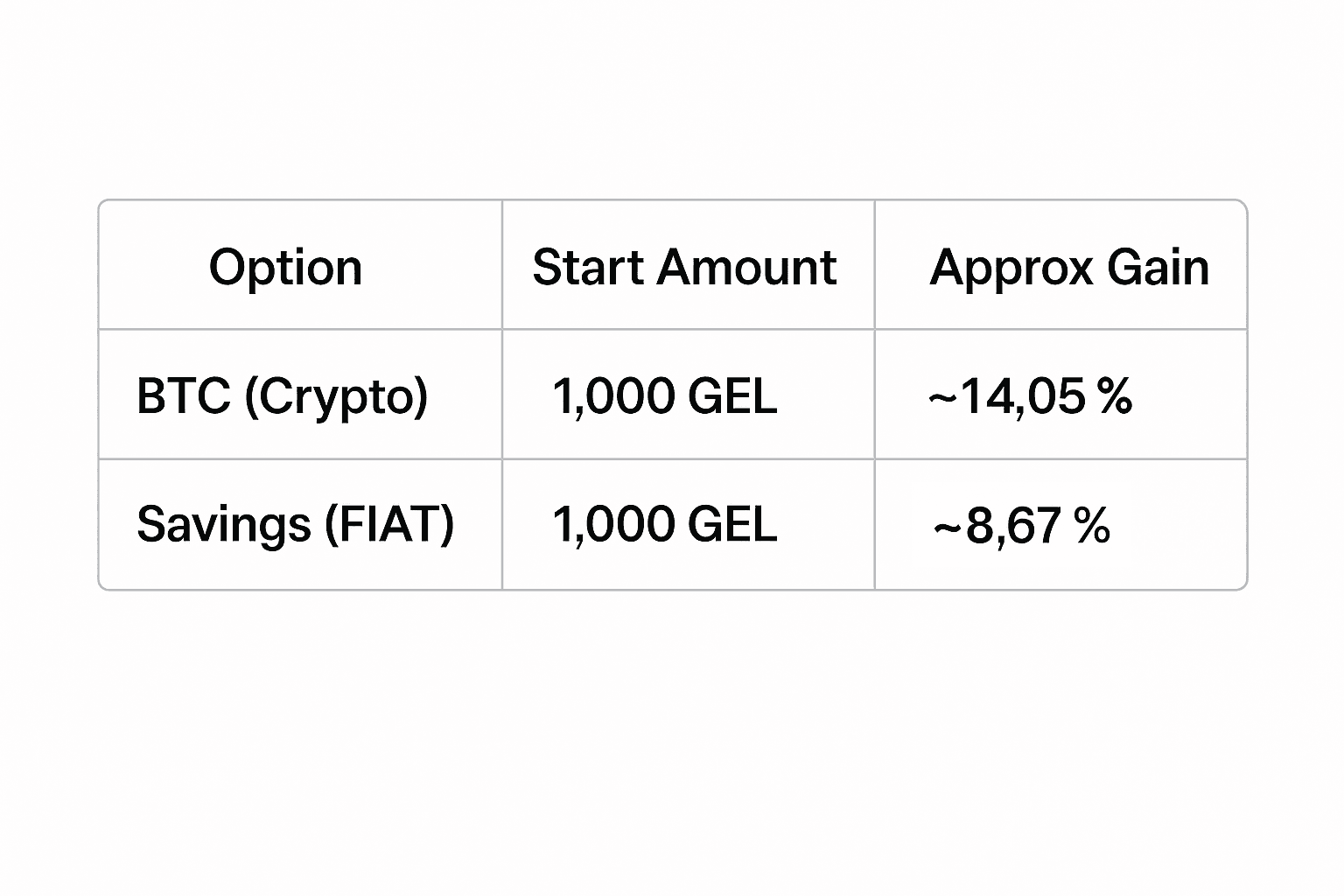

If user bought 1,000 GEL worth of BTC on 1 January 2025

- Assume that on Jan 1, 2025, 1 BTC = USD 100,000 (for simplicity).

- Convert 1,000 GEL to USD (let’s assume 1 USD = 3 GEL, so 1,000 GEL = ~333.33 USD).

- That gives 333.33 / 100,000 = 0.0033333 BTC purchased.

- By Oct 15, 2025, assume BTC price is USD 114,048.7 → value of that BTC = 0.0033333 × 114,048.7 = USD 380.16

- Converting back to GEL at same rate (3 GEL/USD) → ~ 1,140.5 GEL

So, the 1,000 GEL invested in BTC would grow to about 1,140.5 GEL (i.e. ~14.05 % gain) in this scenario.

If user placed 1,000 GEL in a savings account at ~10.97 % annually

- Simple interest for 9.5 months (Jan to mid-October is ~0.79 year) → interest = 1,000 × 0.1097 × 0.79 = 86.66 GEL

- Total = 1,086.66 GEL

So, the 1,000 GEL in savings would grow to about 1,086.7 GEL in that same period.

These figures suggest that, in the scenario used, Bitcoin outperformed traditional savings over that period, though with higher risk and volatility.

Risks and Considerations for Beginners

For beginners, understanding the risks behind both options is essential before making any decision. Bitcoin (BTC), while offering high growth potential, is subject to market volatility, regulatory changes, and emotional decision-making. Its value can fluctuate sharply within days, which may discourage new investors unfamiliar with crypto markets.

On the other hand, savings accounts provide stability but offer limited returns that often fail to outpace inflation. Security is another factor, Bitcoin ownership depends on protecting private keys, whereas bank deposits rely on institutional safeguards. A balanced approach, holding both a secure Bitcoin Wallet and a modest savings account, can provide diversification and reduce risk exposure.

Facts about Bitcoin and Savings

Facts About Bitcoin (BTC)

- The first-ever Bitcoin transaction in 2010 exchanged 10,000 BTC for two pizzas.

- Only 21 million BTC will ever exist, ensuring long-term scarcity.

- Bitcoin operates 24/7 - unlike banks, the network never closes.

- BTC can be divided into 100 million units called Satoshis.

- Georgia ranks among the top countries globally for Bitcoin mining and adoption.

Facts About Savings

- Georgian banks typically offer annual interest rates between 8% and 11%.

- Savings are insured up to 15,000 GEL under the Deposit Insurance Agency.

- Interest income from savings is subject to taxation.

- Savings accounts can lose real value when inflation exceeds interest rates.

- Bank savings offer easy liquidity but limited growth potential.

Which one is Better for Georgians in 2025?

For Georgians in 2025, the better choice between Bitcoin and savings depends entirely on personal goals and risk tolerance. Bitcoin may provide higher long-term returns and protection from inflation, but it also carries significant price volatility.

Savings accounts, by contrast, offer security, fixed returns, and full liquidity, making them more suitable for short-term planning.

A balanced strategy, combining a Bitcoin Wallet for potential growth and a traditional savings account for stability, can be a reasonable middle ground.

Disclaimer: The information provided in this article is for educational purposes only and does not constitute financial or investment advice. Always conduct your own research or consult a financial advisor before making investment decisions.

Final Thoughts

The debate between Bitcoin (BTC) and traditional savings highlights the changing nature of modern finance in Georgia. Savings accounts remain a reliable choice for stability and predictable returns, while Bitcoin stands out for its innovation, independence, and potential for higher gains.

For many beginners, combining both may be the most practical path, using Bitcoin as a long-term store of value and savings for short-term security. As Georgia continues to embrace digital transformation, understanding the strengths and limitations of each option will empower users to make informed decisions in the evolving world of crypto and finance.