What is the Mining Pool? – Easy Way to Mine Crypto Assets

A mining pool is a collective group of crypto miners who combine their computing power to increase the chances of solving complex blockchain algorithms and earning rewards. Instead of competing individually, miners share resources and split rewards based on their contribution to the total hashrate.

This collaboration makes mining more predictable and accessible, especially in 2025 when competition and network difficulty continue to rise. Pools allow even small-scale miners to receive regular payouts, rather than waiting weeks or months for a solo block reward.

Most major crypto assets, including Bitcoin (BTC), Litecoin (LTC), and Dogecoin (DOGE), rely heavily on mining pools to maintain network efficiency.

In short, joining a pool transforms mining from a game of luck into a steady process that rewards participation and teamwork, making it one of the most efficient ways to mine crypto today.

How Mining Pools Work?

Mining pools function by combining the hashrate of multiple miners to collectively solve new blocks faster. This concept, known as Combining Hashrate, ensures that even participants with low computing power contribute to the network’s overall performance.

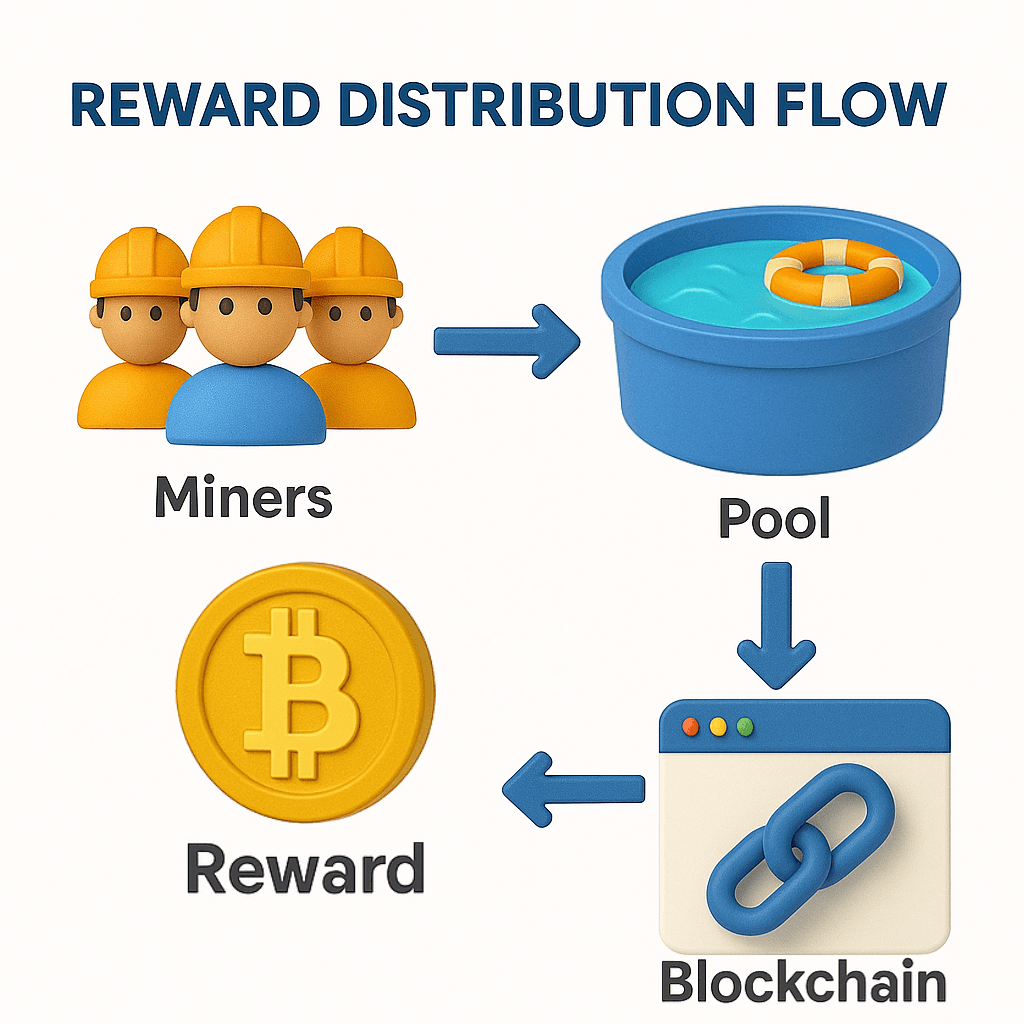

Once a block is discovered, the pool distributes the reward among members according to each miner’s contribution - a process called Reward Distribution. Pools use several payout models to achieve this:

- PPS (Pay-Per-Share): Offers consistent payouts for every valid share submitted, ideal for miners seeking stability.

- PPLNS (Pay-Per-Last-N-Shares): Rewards are distributed based on the number of shares contributed over time - better for long-term participants.

- FPPS (Full Pay-Per-Share): Includes both block rewards and transaction fees, providing slightly higher earnings.

These mechanisms ensure fairness and efficiency, making mining pools a reliable choice for 2025.

Advantages and Disadvantages of Joining a Pool

Joining a mining pool provides stability and reduces uncertainty, but it also comes with a few trade-offs. Understanding both sides helps miners choose the most suitable approach for their goals.

Advantages:

- Steady Income: Frequent and predictable payouts, even for miners with lower hashrates.

- Reduced Variance: Rewards are shared collectively, avoiding long gaps between earnings.

- Lower Entry Barrier: Small miners can participate without needing expensive, high-power setups.

- Community Support: Access to shared tools, updates, and technical guidance.

Disadvantages:

- Pool Fees: Operators charge 1–3% of rewards to maintain infrastructure.

- Centralization Risk: Large pools can control significant network power.

- Less Independence: Individual miners cannot select which transactions to validate.

- Potential Scams: Unverified or unknown pools may misuse funds or manipulate payouts.

How to Join a Mining Pool – Step-by-Step

Joining a mining pool in 2025 is straightforward and can be done in just a few steps. Whether you’re a beginner or an experienced miner, following this process ensures proper setup and optimal performance:

- Choose a Reliable Pool – Research pools with strong reputations, transparent fee structures, and proven payout histories.

- Create an Account – Register on the pool’s official website and verify your email to access the dashboard.

- Connect Your Hardware – Configure your ASIC or GPU miner with the pool’s server address and port details.

- Install and Configure Software – Use trusted mining software like NiceHash, CGMiner, or HiveOS, entering your pool credentials.

- Set Up Your Wallet – Add your crypto wallet address, such as Cryptal Wallet, to receive automatic payouts directly.

Once connected, your rig begins contributing to the pool’s hashrate, and rewards are distributed accordingly.

Best Mining Pools to Consider in 2025

With hundreds of pools available, choosing a trustworthy and profitable one is essential. In 2025, these mining pools stand out for their reliability, transparency, and reward efficiency:

- F2Pool – One of the oldest and most reputable pools, supporting multiple coins like Bitcoin, Litecoin, and Dogecoin with consistent payouts.

- AntPool – Operated by Bitmain, it offers a user-friendly interface, competitive fees, and stable server uptime for ASIC miners.

- ViaBTC – Known for its wide range of supported cryptos and advanced statistics, ideal for both beginners and professionals.

- Foundry USA – A top pool for Bitcoin miners in North America, recognized for high hashpower, strong transparency, and regulatory compliance.

These pools are globally recognized for fair reward distribution, clear fee policies, and efficient performance, making them excellent options for miners entering 2025.

Is Pool Mining Still Profitable in 2025?

Profitability in pool mining depends on a combination of hashrate, electricity costs, network difficulty, and coin prices.

In 2025, most small and medium-scale miners still rely on pools because they provide steady returns and minimize risks associated with solo mining. While Bitcoin’s difficulty continues to rise, joining a reputable pool allows miners to receive regular payouts without waiting for a rare solo block.

However, the margin of profit largely depends on local electricity tariffs - in Georgia, for example, miners benefit from some of the lowest regional energy rates, averaging around $0.03 per kWh. By optimizing power efficiency, maintaining modern ASIC equipment, and choosing pools with low fees, participants can remain profitable even during market downturns.

Compared to solo mining, pool participation remains the more predictable and sustainable option for 2025.

Summary

Mining pools remain a cornerstone of the crypto ecosystem, ensuring fairness and accessibility for miners at all scales.

In 2025, as network difficulty and competition rise, joining a trusted pool is the most practical way to achieve consistent earnings without heavy infrastructure investment. The process is simple -select a reliable pool, connect your hardware, and monitor your performance through mining dashboards.

However, profitability still depends on local electricity rates, pool fees, and hardware efficiency. Miners in regions like Georgia enjoy a natural advantage due to affordable power, giving them an edge in global competition.

For those seeking stability, transparency, and community-driven support, pool mining continues to offer one of the safest and most efficient paths to participate in the blockchain economy while minimizing risks associated with solo mining.