TOP 3 Stablecoins in 2025: USDT, USDC and DAI

In 2025, stablecoins continue to be the backbone of crypto trading and payments. A stablecoin is a type of digital asset designed to maintain a fixed value, typically pegged to a fiat currency like the U.S. dollar.

In a market often defined by extreme price swings, stablecoins provide much-needed predictability and are essential for everyday transactions, trading stability, and decentralized finance (DeFi) operations. Regulatory clarity and strong reserves have become key factors in their sustained adoption.

This article breaks down the top three stablecoins of 2025, USDT, USDC, and DAI, highlighting how each works, how they’re backed, and why they dominate the market today.

New to crypto? Start with our Beginner’s Guide to Crypto Assets to build a solid foundation before diving in.

What is a Stablecoin?

Stablecoins are a special type of crypto assets designed to maintain a stable value over time. Unlike Bitcoin or Ethereum, they aim to reduce price volatility by being backed by stable assets. Here's a quick breakdown:

- Pegged to fiat currencies like the U.S. dollar or euro.

- Designed for low volatility in volatile markets.

- Trusted by traders, institutions, and DeFi platforms.

Stablecoins serve multiple purposes. They’re widely used as trading pairs on exchanges, a way to store value without exiting the crypto market, and essential tools in decentralized finance (DeFi) for borrowing, lending, and earning yield. They're also gaining traction in global payments due to speed and cost efficiency.

There are two main types: fiat-backed (e.g., USDT, USDC) and crypto-backed (e.g., DAI), each with different risk profiles and mechanisms. Learn more in our guide about What is a Stablecoin and Why Do They Matter?

USDT – Tether

USDT, or Tether, remains the most widely used stablecoin in the world as of 2025. With a market cap estimated to exceed $150 billion, it leads the stablecoin market by volume and adoption. USDT is a fiat-backed digital asset, primarily pegged to the U.S. dollar, and is issued by Tether Ltd. Its strength lies in high liquidity and broad support across nearly all centralized and decentralized crypto exchanges.

Common uses include:

- Trading on crypto exchanges

- Storing value during market volatility

- Cross-border transactions

- Everyday crypto payments

Despite its dominance, USDT has faced ongoing concerns regarding transparency and the completeness of its reserve audits. Over the years, these issues have sparked debate but haven't significantly impacted its usage.

Want to learn how to buy USDT? Read our full blog here: Buy USDT – Detailed Instruction.

USDC – USD Coin

USDC, short for USD Coin, is one of the leading stablecoins in 2025, known for its transparency and regulatory alignment. Issued by Circle, USDC is fully backed by U.S. dollar reserves and undergoes regular third-party audits. This makes it one of the most trusted stablecoins among institutional investors and regulatory bodies alike.

USDC is also supported by major platforms like Coinbase and is widely integrated into both crypto and traditional financial systems. While its trading volume is slightly lower than that of USDT, it is increasingly favored for its reliability and clear backing structure.

Common uses include:

- Popular asset in DeFi protocols

- Preferred for institutional crypto payments

- Used for dollar-denominated settlements in blockchain apps

Thanks to its growing reputation and real-world integrations, USDC is gaining traction steadily. Users can easily buy USDC directly through Cryptal, making it accessible to both retail and professional crypto users.

DAI – Decentralized and Crypto-Backed

DAI stands out as a decentralized stablecoin developed by MakerDAO. Unlike fiat-backed options like USDT or USDC, DAI is backed by crypto assets and maintained through a system of overcollateralization. Its peg to the U.S. dollar is achieved by smart contracts and governed by holders of the Maker (MKR) token, ensuring community-led control rather than centralized oversight.

DAI is backed by assets such as Ethereum, USDC, and other cryptos held in smart contracts, making it a staple in the decentralized finance (DeFi) ecosystem.

Common uses include:

- Trusted for lending protocols

- Popular in borrowing and staking platforms

- Key token in yield farming strategies

While DAI can show mild volatility during intense market events, it remains highly resilient due to its design. For those interested in decentralized options, DAI is available for purchase on Cryptal, offering a balance of autonomy and utility.

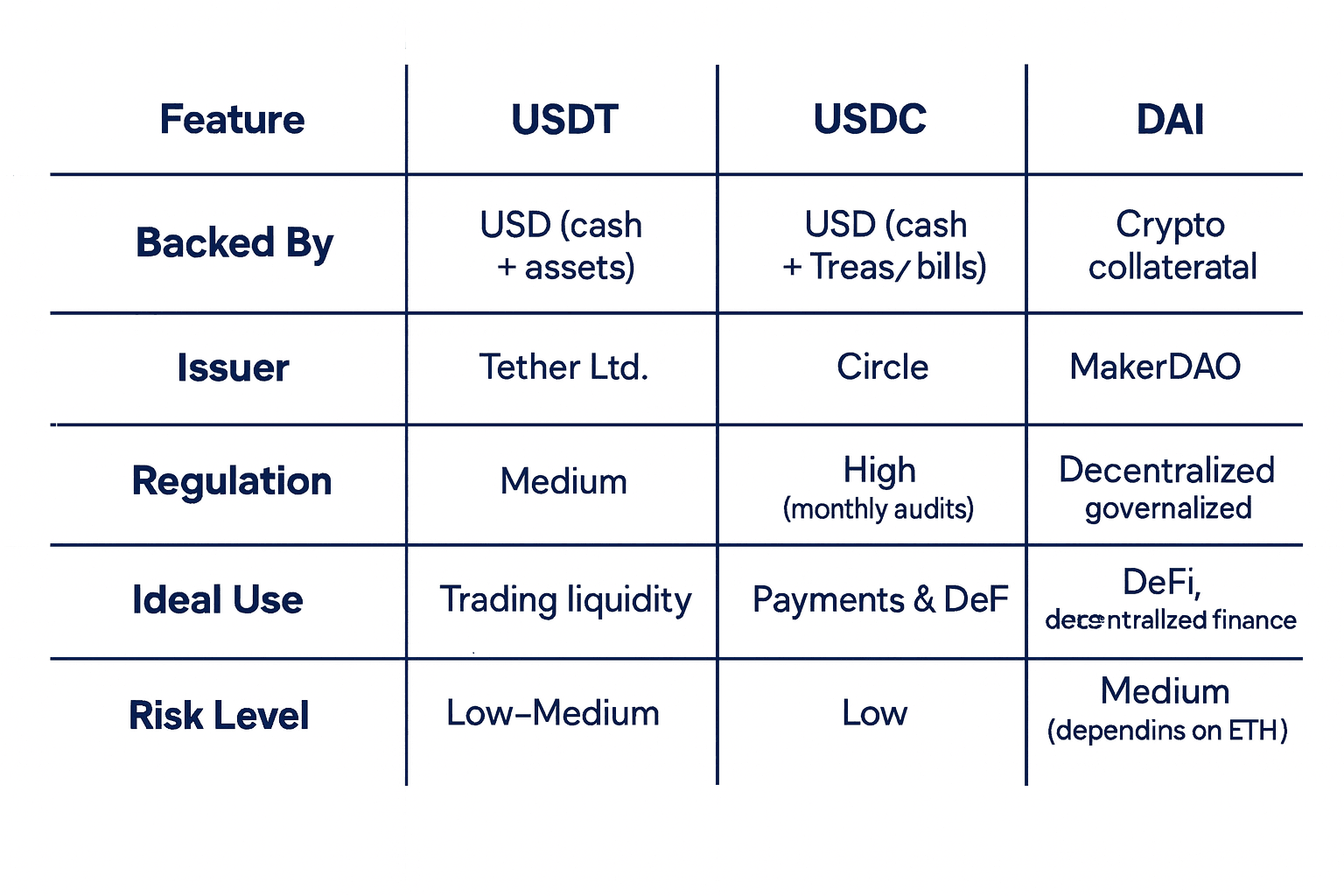

Comparison Table – USDT vs USDC vs DAI

Why These 3 Dominate the Market

USDT, USDC, and DAI have emerged as the most dominant stablecoins in 2025 due to a combination of adoption, trust, and infrastructure integration. Their market leadership is not by chance, it’s rooted in a few key factors that ensure their presence across every major sector of the crypto economy.

- Massive adoption across exchanges and wallets, making them easily accessible

- Liquidity and trust from both retail users and institutional investors

- Built-in support in DeFi protocols, wallets, and Web3 ecosystems, allowing seamless functionality

- Balance of centralization (USDT/USDC) and decentralization (DAI), catering to different user preferences

This trifecta of adoption, utility, and strategic positioning helps these stablecoins serve as reliable tools in trading, saving, and building within the broader crypto market.

Summary – Stablecoins are the Bridge to Real-World Money

In 2025, stablecoins continue to serve as the financial bridge between the volatile world of crypto and the stability of traditional finance. USDT remains the liquidity king, dominating global trading volumes. USDC stands out for its transparency and regulatory alignment, making it a preferred option for institutions and compliance-conscious users. DAI offers a decentralized alternative, trusted by DeFi platforms and users valuing autonomy.

Each of these stablecoins plays a unique yet vital role in the broader crypto economy. From facilitating cross-border payments to enabling complex DeFi operations, they provide the stability needed for adoption and innovation. Their continued evolution ensures that stablecoins remain the backbone of crypto trading, investment, and real-world integration.